Guide to Cannabis and Hemp Risk

Uncover the basic elements of cannabis and hemp risk and how to protect against them

As the cannabis and hemp industries continue to grow, the associated risk increases too.

As the cannabis and hemp industries continue to grow, the associated risk increases too.

How to use this guide

This guide serves as a hub for information regarding cannabis and hemp risks, including steps to minimize these risks. In each section, we provide links to additional articles from our blog, allowing you to learn more on any given subject.

BuildingMetrix® is proud to be a part of WSRB which has inspected properties, evaluated communities, and helped insurance companies understand and underwrite risks in Washington state for over 125 years. Originally focused on fire risk data, WSRB saw the need to help our customers understand other new and evolving risks throughout the entire United States, resulting in the creation of BuildingMetrix. After incorporating data related to earthquake risk, the growing market for cannabis and hemp has allowed us to expand our scope once again. We have developed tools to help find and manage cannabis and hemp risks wherever they are found in the US.

When you partner with BuildingMetrix, you get access to valuable solutions, industry knowledge, and friendly, knowledgeable service for properties throughout the United States. Learn more about what we offer.

Risks

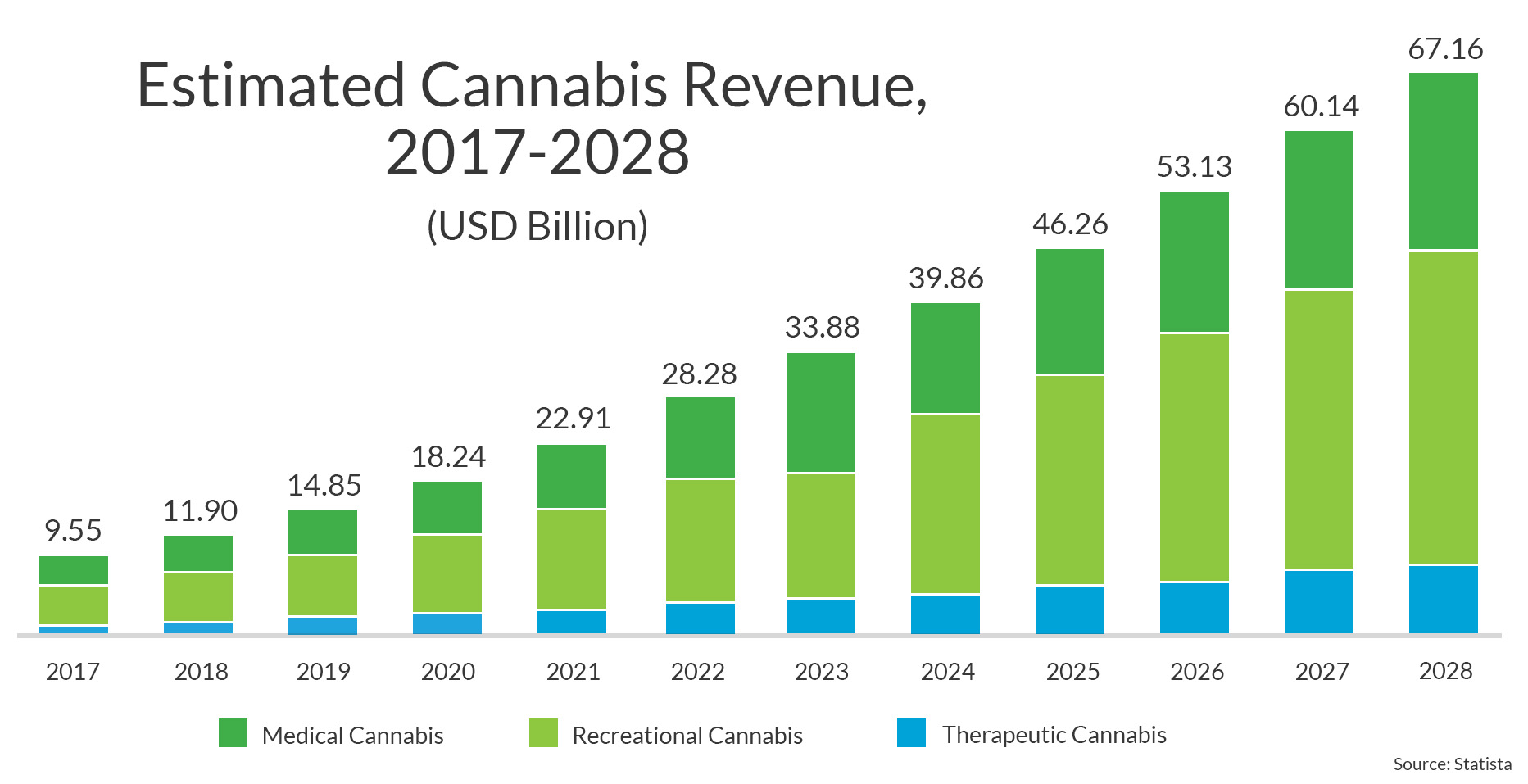

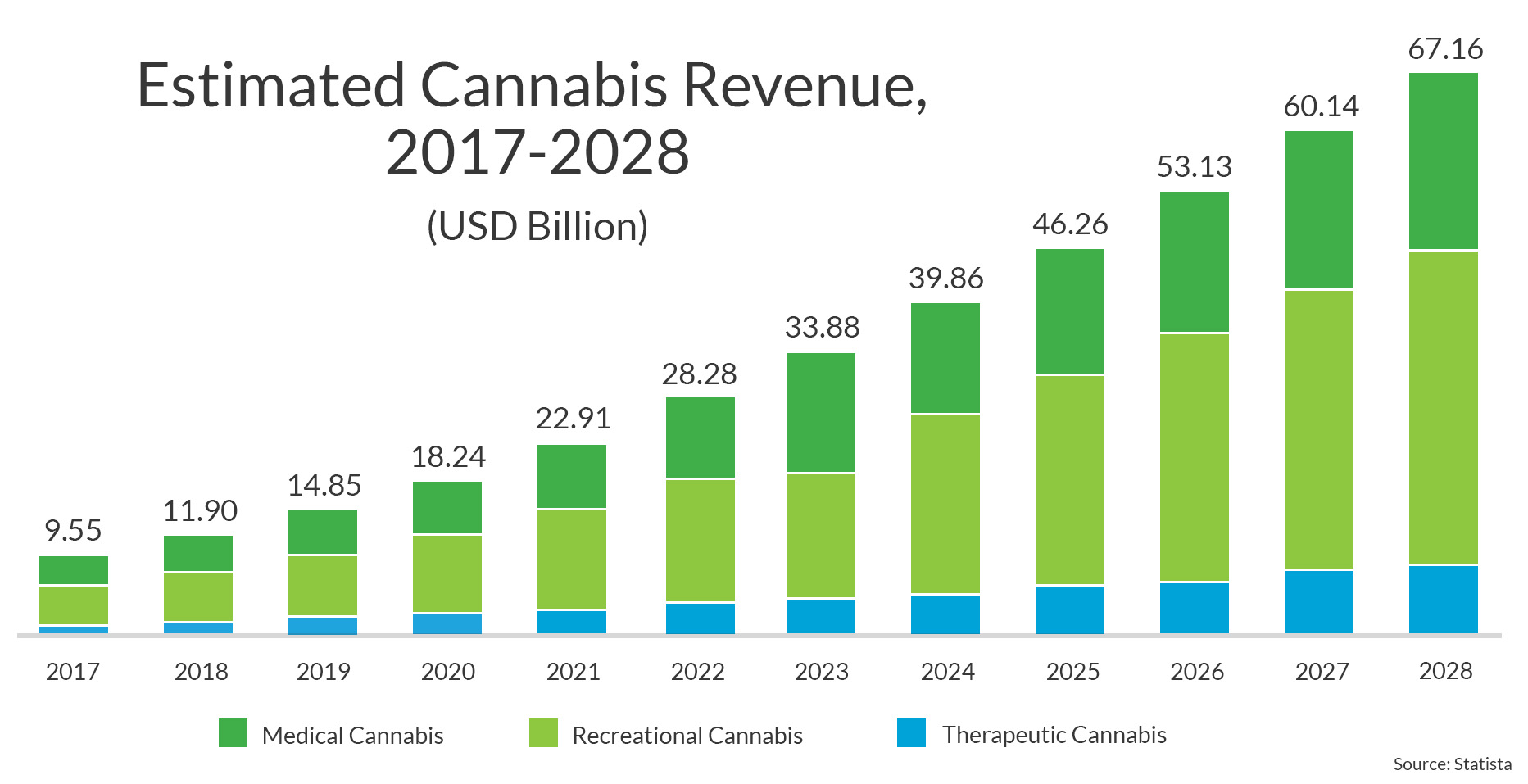

The cannabis industry is growing quickly in the United States. More than half of U.S. states, including the District of Columbia, have made marijuana legal for medical or adult use. Sales continue to skyrocket with this expansion, and if current trends continue, revenue is expected to reach nearly $40 Billion in 2024.1

67%+ of Americans believe marijuana use should be legal, making it likely that expansion the medical and recreational cannabis (including the edible market) will continue.

Unlike cannabis, hemp is not a Schedule 1 drug under the Controlled Substances Act and therefore has more widespread cultivation across the country. Even with the industry in slight decline (down to 465,787 acres in 2020 from 511,442 acres in 2019), the expansive use of hemp in everyday products like beauty and medical supplies is important to understand.

Hemp-derived CBD products generated $390 million in sales in 2018, with projections of $1.2 billion in 2022. The total sales of all hemp products are projected at $2.61 billion by 2022. Other hemp-derived products include the increasingly popular delta-8.

Learn more about the history, uses, and risks of hemp.

Main risks

Cannabis and hemp processing and retailing operations continue to increase their footprint, creating multiple types of property risks. Three of the main property risks that impact insurers are fire, explosion, and theft.

Fire

Marijuana and hemp growing operations require extensive lighting systems and consume large amounts of electrical power. If the building being used is not properly converted to handle the increased power demand, the system becomes strained and, as a result, creates fire risk. The fire chief in Port Angeles, WA gives a first-hand account of a cannabis operation catching fire and causing extensive property damage and harm.

Explosion

Extraction of THC from the marijuana plant material is an important step in creating oils and tinctures. The process most often employs the use of butane, a highly combustible gas. Explosions can occur if not done properly. Extraction methods using carbon dioxide, ethanol, or water are safer, but many extraction facilities have not adopted these practices. Recent explosions in Washington, California, Arizona, New Mexico, and Oregon speak to this growing problem. Hemp oil is also extracted using various processes that can lead to significant fire risks, much like cannabis.

Theft

Cannabis retailers deal almost entirely in cash due to banking restrictions. Marijuana shops are prime targets for thieves because they carry large amounts of cash (often including an ATM on-premises) and high-value merchandise. The value of hemp oil is significant, with the cost of a kilogram ranging from $400-1,000 depending on quality and degree of processing. This is an attractive theft opportunity given the value of just one 50-gallon barrel.

Dispensaries in the Portland, Oregon area were robbed of nearly $600,000 over the course of one year. In western Washington, theft has become a normalized cost of business for the cannabis industry.

Hidden risks

Many risks associated with cannabis and hemp are apparent and well known; however, there exist other forms of risk that hide beneath the surface. These risks must be understood and identified to fully understand and assess the underwriting risk. Let’s investigate the hidden risks of cannabis and hemp and how they might affect you.

Proximity

Proximity to a cannabis or hemp location creates risks of explosion, fire, property damage, and theft. Risk of an explosion caused by butane-based extraction processes, a fire caused by improperly wired lighting and electrical systems or theft of cannabis retailers or hemp storage warehouses increases when exposed to cannabis and hemp operations.

Delivery services

Delivery services exist as a popular and easy method of purchasing cannabis products. However, delivery drivers are at risk: they carry both valuable products and large amounts of cash, making them attractive targets for criminal activity. If you’re unknowingly insuring a delivery service, you could face costly workers' compensation claims and thefts should something happen to one of the delivery drivers or what they carry.

Product liability

Cannabis has not been legalized at the federal level, making data regarding the long-term effects of regular usage unknown. No one can be sure how ingesting, smoking, vaping, or topically applying cannabis products could adversely affect one’s health until more research is done. Legalization will bring increased liability, from design and manufacturing defects to potentially long-term side effects. Lawsuits related to cannabis consumption will cost insurers money. We will talk about this type of risk more in the next section regarding long-term risks.

Cannabis on personal lines

When it comes to cannabis growers and processors operating on a personal lines policy, there is zero chance that any standard insurer would willingly maintain such a policy. However, in the course of our work, we've discovered that cannabis operations on personal lines policies do exist, and they are exceedingly hard to uncover without the right data and tools.

Learn more here.

Long-term risk

Cannabis product liability is the most pressing long-term risk.

Cannabis is not a federally legal drug. The U.S. federal government classifies it as a Schedule I drug, designated as having “no currently accepted medical use and a high potential for abuse.” Other drugs in the same category are heroin, ecstasy, and LSD.

Conducting any sort of research on its potential health benefits is a tricky endeavor. Getting approval to study marijuana and its derivates is a time-consuming, costly, and difficult process. Colleges and universities with impressive medical research facilities are denied access to the drug for fear of losing their federal funding. Most of the data that has been collected thus far has been developed using less than rigorous methods and findings remain inconclusive.

So where does this leave us? Limited research means limited product liability risk data for insurers to understand, mitigate or price the risk. How can you estimate the cost of potential future claims or make sound underwriting and pricing decisions without relevant data?

Even if you don't deal directly with cannabis or hemp operations,

Even if you don't deal directly with cannabis or hemp operations,

hidden risk can still make its way into your book of business.

Risk and corporate values

Each organization should also consider if insuring cannabis or hemp risk aligns with its corporate values.

The demand for insurance is through the roof: in 2020, cannabis sales totaled over $17.5 billion; but the insurance industry only wrote approximately $250 million in policies. Federal roadblocks appear to be changing as legalization pushes forward, and many insurers are gearing up to capitalize in states where the drug is legal. Hemp has grown, but many states have been wary to provide licensing given the unknown future and acceptability of the products.

Insurers still need to remember that federal law classifies cannabis as a Schedule I drug. The stigmatization of the drug still has a deep hold on the American psyche, making it hard to challenge long-held beliefs about marijuana. Many insurance company boards and policyholders have no interest in providing coverage for either cannabis or hemp.

How can you assess your company’s appetite for insuring these risks? Consider the following:

Ethical values

Keep in mind the nature of your constituencies, including legislation and the public perception of those you serve, to maintain your moral standing.

Financial values

A novel and volatile market like cannabis or hemp offers many unknowns. and involvement could lead to financial losses in the future. This could prompt some to stick to more predictable and understandable lines of business.

Underwriting value

There is little data on cannabis or hemp that can be utilized for insurance purposes. To balance risk and return, make sure your underwriters have enough information to properly evaluate every aspect of these risks.

Marketing values

Ethical positioning about the types of business you write will help you present your company in the way you want and influence your marketing decisions.

It is also important to be aware of potential risks and whether these have made their way into your book of business regardless of whether your company has a position on cannabis and hemp. If you choose to avoid analyzing your book for cannabis risk, you might find that you have a lot more of it than you want. Ignorance is not bliss – it is dangerous and could cause your risk concentration and loss ratios to increase.

Case studies

Identifying and Eliminating $50 Million in Risk

Learn how one property insurer efficiently located $50 million in cannabis-related property risk - in just one state - and removed that risk from its book of business.

Million Dollar Loss that Could Have Been Avoided

A fire in a cannabis facility was so destructive that the entire building was declared a total loss. Later, the insurer covering the property learned that, with the right data, it could have avoided the loss.

A Costly Risk That's Difficult to Locate

Discover how cannabis growers, processors and retailers end up in your book of business, how difficult this risk can be to quickly locate and how costly it can be for insurers seeking to avoid it.

While managing cannabis and hemp risk can be a daunting task,

While managing cannabis and hemp risk can be a daunting task,

we've developed tools to help you handle risk effectively.

Reducing risk

How cannabis businesses end up in property insurers' books of business

Cannabis and hemp risks often become apparent only after an incident occurs. But how did it get into the insurance companies’ book in the first place?

Businesses change all the time. It’s common for a business to apply for insurance before having anything to do with cannabis and, over time, occupancy changes occur that include cannabis or hemp operations. Notifications to the insurance company do not occur, and the unknown risk remains within the book. Applications can be incomplete and fail to disclose the true nature of the operations which leads to policy issuance.

No matter how they end up in your book, reducing this risk is important.

How to reduce exposure

The traditional method of uncovering risk involves underwriters continually combing their books and searching out occupancy changes through agency inquiries or Google searches. This process requires reviewing each policy and hunting for clues to determine whether a given business is operating in cannabis or hemp. The process is time-consuming and can easily get missed on a busy underwriter’s desk.

Traditional methods of finding these risks are inaccurate and may not uncover potential cannabis and hemp locations. Reliable data on cannabis and hemp businesses is in short supply, with different states offering different tools. It is time-consuming to figure it all out. Underwriters are put under an immense amount of pressure to review potential cannabis and hemp-related policies, a never-ending task with great potential for error.

There must be a faster, easier way…

BuildingMetrix Suite

We’ve developed the ideal solution to quickly and accurately find risk both in your book of business and in close proximity to properties you cover.

Introducing BuildingMetrix CannabisFind and HempGuard. Built to provide you with information on cannabis and hemp businesses in your book, these tools allow underwriters to save time and focus on what they do best. Utilizing Geographic Information Systems (GIS) knowledge and technology in conjunction with state licensing agency data and other data sources, our experts validate data to provide accurate cannabis and hemp risk information on retailers, processors, growers, and transporters.

CannabisFind provides data in all the states where marijuana is currently legal for recreational use. The hemp database is growing quickly, with most states in the process as licensing expands. Available data will be incorporated into the tools as more states legalize marijuana and license hemp.

Don’t let cannabis and hemp risk hamper your business. Find out if cannabis and hemp-related risk is hiding in your book, allowing you to make an informed decision about writing or renewing policies. Use CannabisFind and HempGuard to tackle cannabis and hemp risk once and for all.

Still have questions?

We hope this guide and the linked articles gave you new insight into cannabis risk. If you still have questions, contact our customer service team.

[1] Statista, https://www.statista.com/outlook/hmo/cannabis/united-states

As the cannabis and hemp industries continue to grow, the associated risk increases too.

As the cannabis and hemp industries continue to grow, the associated risk increases too.

Even if you don't deal directly with cannabis or hemp operations,

Even if you don't deal directly with cannabis or hemp operations,  While managing cannabis and hemp risk can be a daunting task,

While managing cannabis and hemp risk can be a daunting task,