About the Company

Who we are and how we help property insurers and agents throughout the U.S.

CEO Perspective

Engaging thought leadership on key insurance industry issues from our CEO.

Meet the Team

InsuranceEDGE

Keep up with changes in the P&C industry with our weekly newsletter.

Underwriting Guide to Cannabis & Hemp

An underwriter’s guide to risk and how to protect against it.

BuildingMetrix Blog

Learn about key insurance trends and how data helps you navigate them.

Agency Guide to Earthquakes

Help your customers understand and be covered for earthquake risk.

Case Studies

Discover customer success stories powered by BuildingMetrix solutions.

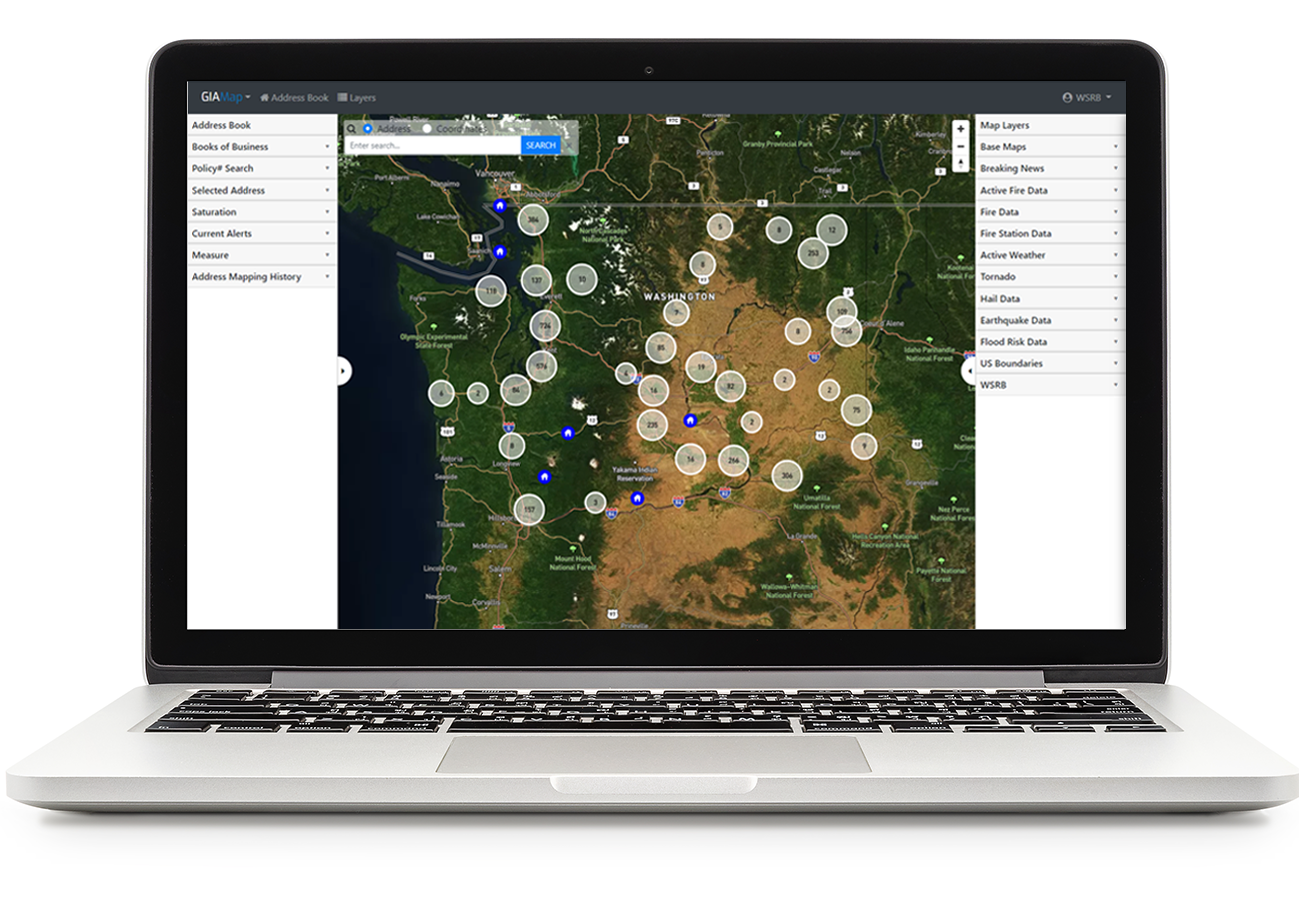

A Guide to Geospatial Technology

Harness the latest tools to achieve your underwriting goals.

Help Center

Get step-by-step how-to articles on all BuildingMetrix data products.

About the Company

Who we are and how we help property insurers and agents throughout the U.S.

CEO Perspective

Engaging thought leadership on key insurance industry issues from our CEO

Meet the Team

InsuranceEDGE

Keep up with changes in the P&C industry with our weekly newsletter.

Underwriting Guide to Cannabis & Hemp

An underwriter’s guide to risk and how to protect against it.

BuildingMetrix Blog

Learn about key insurance trends and how data helps you navigate them.

Agency Guide to Earthquakes

Help your customers understand and be covered for earthquake risk.

Case Studies

Discover customer success stories powered by BuildingMetrix solutions.

A Guide to Geospatial Technology

Harness the latest tools to achieve your underwriting goals.

Help Center

Get step-by-step how-to articles on all BuildingMetrix data products.

A Guide to Wildfire Risk

Everything you need to know about managing this growing risk.